Moms and Money: Simple Yet Effective Budget Tips to Make Every Dollar Count

By the time your little bundle of joy turns 18, it is estimated that you will spend over $233,000 for childcare, according to the Department of Agriculture. So beyond making sure that you take good care of yourself, you'll have to get a stronger handle on the family finances. That being said, what budgeting tips can help you make every dollar count?

Check Out Utility Options

The average U.S. family spends about $2,200 on utility bills per year, according to the U.S. Department of Energy. They also noted that half that amount is taken up by heating and cooling alone. A good option is to check if there are alternate energy providers that offer better rates. For example, households that use natural gas have an average monthly bill of $82. So if you find that there are better energy providers in your area, do a bit of research so you can compare rates and plans they may offer you. That way, you determine what option offers more savings down the line.

Establish a Budget Calendar

Only 25% of Americans say that everyone should have a budget, according to Debt.com's poll. Not having an organized look into your finances is a good way to start overspending and losing track of where your money goes. A good way to combat this is to have a budget calendar. It's an effective financial tool that provides a visual reminder of important monetary commitments. Having a budget calendar helps you plot out where your money should actually be going. It can also help you plan your goals like a dream vacation or something that's needed around the house.

Do Shopping Off-Season

When you're trying to save money, you need to plan any purchases wisely. A good way to get massive savings and get things you need is to do your shopping off-season. For example, if you need to buy new sheets or bedding, the best time of year to do so is in January. Most places have a "white sale" that offers up to 50% off the retail price. If you need furniture for your kid as they grow, September is the best time to buy as it approaches Labor Day weekend where most things are on sale. Off-season shopping schedules can give you time to plan what else you may need so you can compound your savings.

Enacting small yet effective money-saving measures in your home has both short-term and long-term benefits. So the sooner you start, the better your chances of obtaining more savings that you can use for other things for your family. Just take your time to figure out if you need to do any additional adjustments so you can maximize your savings.

1 Response

Aira

I have been browsing online greater than three hours lately, yet I by no means discovered any interesting article like yours. It is pretty price sufficient for me. In my opinion, if all website owners and bloggers made good content material as you probably did, the internet will be a lot more useful than ever before.

온라인 카지노

카지노사이트

바카라사이트

토토사이트

호텔 카지노

https://www.j9korea.com/

Leave a comment

Also in News

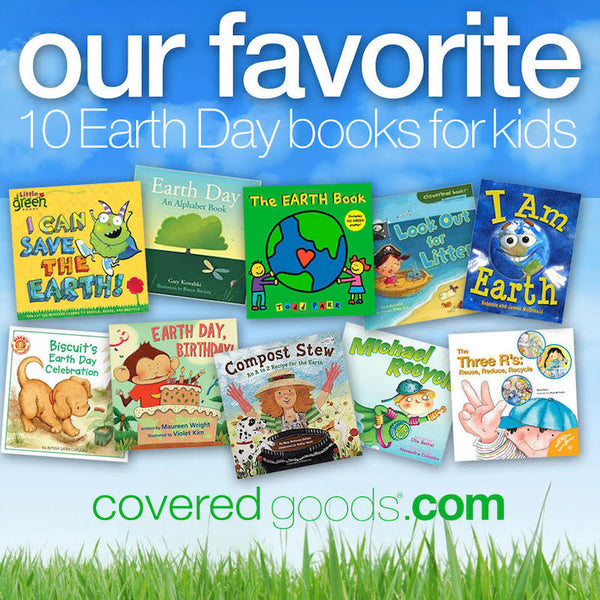

Our 10 Favorite Earth Day Books for Kids

6 Toddler Essentials You Need this Spring

Covered Goods, Inc.

Author